![]() Services Overview

Services Overview

Mergers and Acquisitions - Exploring the Options

Petroleum

Revenue Streams

Taking advantage of the ability to realize exponential growth potential

and profits to support its humanitarian capitalism philosophy, Das Global

Capital Petroleum Corp. have diversified its global energy development

approach to refocusing on Windfall Clean Energy technology, solar energy

and bio fuel energy technology development.

1.

Oil and Gas Distribution (downstream)

2. Crude Oil trading (upstream)

3. Oil and Gas Distribution globally)

In 2011 the Das Global Capital Petroleum will also focus on downstream activity – responding to wholesale and retail distribution of gasoline, diesel, lubricants, oil and greases, as well as offering fluids management solutions.

The Petroleum Products market is very stable. Fluctuations in crude oil prices have little or no impact on demand. Even during economic downturns, demand remains constant. This sector continues to offer high volume competitivemargins, and includes delivery to end users in the broad marketplace.

Das Global Capital Petroleum Derivatives and Debentures Trading

Given its potential in global assets acquisition in the 100s of billions of dollars and the dynamic and phenomenon in the leveraging and creative management skill of these assets acquired, Das Global Capital Petroleum Organization through its investment banking affiliate, intends to engage in derivatives, stocks, bonds and debentures trading.

Derivatives as defined by Investopedia: Written by Cory Janssen and Cory Wagner {Mc Graw Hill} and edited by Jack Guinan, creator of ‘The Closing Bell Cartoon. (A Wall Street Phenomenon). Are “securities whose price is dependent on or derived from one or more underlying assets”. Derivatives itself merely consists of contract between two or more parties, with a value determined by fluctuations in the underlying assets, which could be stocks, bonds, commodities, currencies, interest rates, and market indexes. Most derivatives are known to the global market place to be characterized by high leverages.

Debentures as defined: Are debt instruments that are not secured by a physical asset or collateral. Debentures are backed only by a general creditworthiness and reputation of the issuer. Therefore, Das Global Capital Petroleum as a potential global membership organization with enormous acquired assets can issue debentures to its members or interested institutions or organizations, to raise capital for development in its global energy and gold mining ventures.

Das Global Capital Petroleum and its global strategic alliances intend to establish reputation for moving petroleum products from pipelines and marine vessels to the consumer at large, through its planned strategic distribution networks and acquisitions of refineries and transportation tankers and Vessels around the world to serve the people and underprivileged world population.

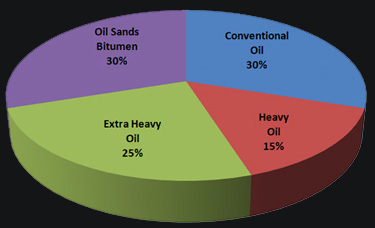

Total World Oil Reserves

Crude Oil Trading

The upstream component – crude oil trading – requires a higher net worth to participate, but offers a much higher margin of return.

Upstream

refers to the activities supporting the mapping, exploration, trading,

and acquisition, through delivery of crude Oil to the Refinery.

It involves networking with major oil producing countries and dealing

with the Heads of State.

Global

upstream opportunities exist with West Africa, North Africa, Southern

Africa and the Arabian Gulf, which will be used as a target based on the

history of Das Global Capital Petroleum global strategic knowledge of

the political economic of the African continent.

![]()

![]()

![]()

Both distribution and crude oil trading require the high level of support and knowledge regarding the specific requirements of the oil and gas industry that Das Global Capital Petroleum would continually demonstrate on the global scene.

Competitive Advantages:

The Das Global Foundation will use its global humanitarian outreach to foreign governments to acquire oil and gas concessions rights. The profits to be derived from drilling and exploitation of these oil and gas reserves will be solely used to trickle down benefits to the masses of those nations we are morally obligated to serve.

Global Economic & Strategic Development:

Our mission is to build upon our concept and philosophy of Humanitarian Capitalism. A philosophy and reputation for excellence in global business by delivering innovative and creative E-commerce energy solutions, to meet the diverse petroleum fueling and petroleum product needs to the masses of the world at affordable price and to provide an unparalleled level of service and efficiency for the negotiated purchase and sale of bulk fuels, on-site fueling and management of petroleum related processes from the refinery through the retail pump and to invest in clean energy development.

Actions to accomplish this strategy:

Utilize E-commerce technologies and collaborative partnerships to build a seamless fuel distribution network for end users with Bulk and Retail Card requirements. Provide efficiencies and economies of scale throughout North, Central, South America distribution network as well as Asia, Western, Eastern, Central Europe, Middle East and Africa by developing sufficiency in global energy strategic solutions.

Immediately negotiate Fuel Contracts with Shell, Exxon Mobil, Chevron and others as may be necessary to fulfill contract requirements with customers, until such time Das Global Capital can become fully capacitated to supply demand of our masses.

Implement supply chain management solutions that reduce overall cost and maximize profits for industrial manufacturers and suppliers.

Establish further on-line presence in the petroleum distribution market by investing in Business-to-Business technologies that allow seamless integration in the developing global energy market. Supply E-commerce solutions that bolster customer relationships, forge new relationships and enhance Das Global Capital Petroleum marketing in the global marketplace.

Form new global strategic alliances/partnerships that fuel a high-growth nationwide network. Redefine global solutions involving petroleum and industrial fluid products/services.

Additionally, a growth and exit strategy that includes presenting a private or public offering of Das Global Capital Energy Bonds over the next two to three years shall be a part of the overall strategy towards our concept of a global economic development to assist developing and third world nations reduce poverty and increase micro-economic growth.

Quality Policy

Capital shall be invested in management and staff commitment to meeting customer needs and expectations with on-time delivery of a top quality product, and to increasing customer satisfaction through continual improvement of our services and our Quality Management System.

Opportunities

Opportunities exist for immediate short-term explosive growth with a high probability of success. Negotiations and deals currently underway include the following: Production of Das Global Capital Energy offering, acquisitions of financial institutions, refineries, and oil and gas leases from Texas, Tennessee, Utah to Canada, South and Central America to the Baltic’s and the African nations of Guinea, Ghana, Equatorial Guinea, Cameron, Liberia, Mauritania, Sudan, Nigeria, Angola and Chad.

Crude Oil Trading

A realistic, though highly political, opportunity to obtain an allocation from the NNPC is underway, with direct contact to the highest government levels in Nigeria, through the Asahoba Petrochemical Complex Limited, located in Imo State of Nigeria, a sister subsidiary company of Das Global Capital Petroleum Corp.

![]()